35+ cap on mortgage interest deduction

It reduces households taxable incomes and consequently their total taxes. Ad Compare the Best Home Loans for February 2023.

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on.

. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. The home mortgage interest deduction allows you. For tax year 2022 those amounts are rising to.

Visit PIMCO Today For Actionable Investing Ideas. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Web If you take out a mortgage in 2018 for a home that costs 1 million you could potentially deduct interest on only the first 750000 of that loan.

Web The mortgage interest deduction allows you to reduce your taxable income by the amount of money youve paid in mortgage interest during the year. Web Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017. Web Depending on how big your mortgage is you may encounter a cap on the interest you can deduct.

Apply Get Pre-Approved Today. Ad Is Your Portfolio Positioning Ready For Changing Interest Rates. Web The mortgage interest deduction is a tax deduction you can take for mortgage interest paid on the first 1 million of mortgage debt during that tax year.

Web A taxpayer spending 12000 on mortgage interest and paying taxes at an individual income tax rate of 35 would receive only a 4200 tax deduction. Web The home with the secured loan must have sleeping cooking and toilet facilities. If your mortgage was in place on December 14 2017 you can.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web Homeownership comes with several perks including the ability to deduct the interest you pay on your mortgage.

Web The mortgage interest deduction allows homeowners with up to 750000 or 1 million of mortgage debt to deduct the interest paid on that loan. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals. Lock Your Rate Today.

The debt cant exceed 750000 or 1000000 if the loan was taken before December 16 2017 to. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. Get Instantly Matched With Your Ideal Mortgage Lender.

For married taxpayers filing separate returns the. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. So if you have.

Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. If you live in an area.

Mortgage Interest Deduction Is Limited To Interest Paid During The Year Shindelrock

Maximum Mortgage Tax Deduction Benefit Depends On Income

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

Race And Housing Series Mortgage Interest Deduction

Cayman Resident 2023 By Acorn Media Issuu

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Tax Reform With 750k Cap On Mortgage Interest Deduction Would Leave 1 In 7 U S Homes Eligible Zillow Research

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Home Mortgage Loan Interest Payments Points Deduction

Mortgage Interest Deduction How It Calculate Tax Savings

Is Education Loan Interest Paid During Moratorium Period Eligible For Tax Deduction Under 80e Quora

Social Security United States Wikipedia

Solved The Standard Deduction For Mortgage Interest Under Chegg Com

What Is The Mortgage Interest Deduction The Ascent

Mortgage Interest Tax Deduction What You Need To Know

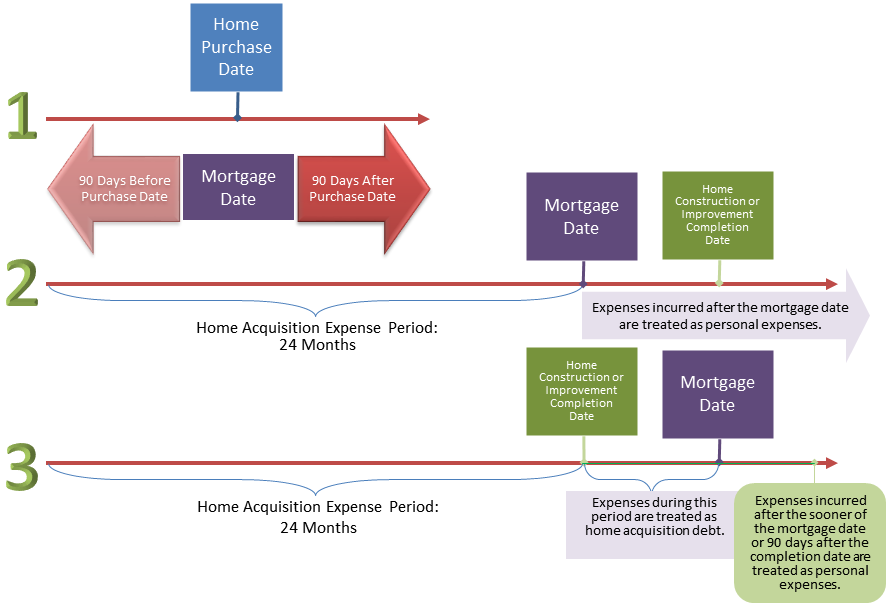

Itemized Deductions For Interest Expenses On Home Mortgages And Home Equity Loans